Investing in Crypto Is Risky, But These 2 Cryptos Have Serious Staying Power

By Dominic Basulto – Aug 11, 2024 / The Motly Fool

Key Points

- The recent downturn in the crypto market has many investors looking for “safe” crypto investments.

- Both Bitcoin and Ethereum have historical track records of bouncing back from market downturns.

- New ETF products for Bitcoin and Ethereum are helping to reduce some of the risk of investing in crypto directly.

Both Bitcoin and Ethereum have long track records of bouncing back from crypto market adversity.

The recent turndown in the crypto market has been jarring, to say the least. In a 24-hour period, the crypto market saw $367 billion in value wiped away. During that time period, Bitcoin (BTC -2.04%) fell by 15%, and Ethereum (ETH -2.54%) fell by 22%. It’s not just the steep downward descent in prices that has crypto investors worried — it’s also the speed and velocity at which it occurred.

Despite their recent volatility, Bitcoin and Ethereum are the two cryptos that I still feel comfortable adding to a crypto portfolio in 2024. Both cryptocurrencies have been around for more than a decade, showing their serious staying power, and both have delivered unparalleled returns to investors over that time period. Let’s take a closer look at what makes them special.

Bitcoin

Bitcoin continues to be the gold standard for crypto investors. In fact, Bitcoin is often referred to as “digital gold” for its unique properties that resemble, to a certain degree, those of physical gold. Most importantly, Bitcoin has a limited lifetime supply of 21 million coins. Currently, there are nearly 20 million coins in circulation, so we’re nearing a point where almost all the Bitcoin that will ever be created has already been created. That gives Bitcoin enormous scarcity, and that’s why some crypto investors now hoard Bitcoin the same way other investors hoard gold.

Image source: Getty Images.

Bitcoin, far more than any other crypto, is underpinned by a long-term, buy-and-hold mentality. Rule No. 1 of Bitcoin is: Never sell your Bitcoin. Indeed, Bitcoin investors have popularized a number of terms (including “HODL” and “Diamond Hands“) to refer to the process of holding on to their Bitcoin, no matter what’s happening around them in the crypto market.

It might be surprising to find out how many long-term holders of Bitcoin there really are, given how often we hear about short-term Bitcoin speculators. In mid-June, nearly 14 million bitcoins were held by long-term investors, according to data from Glassnode. This is really an underrated aspect of Bitcoin, and something that gives the crypto enormous staying power. With institutional buyers now investing in Bitcoin, it should help to reinforce the buy-and-hold mentality that has developed among smaller retail investors.

Finally, it’s impossible to ignore the long-term resilience of Bitcoin. According to Cathie Wood of Ark Invest, there have been at least five different drawdowns when the price of Bitcoin fell by 77% or more. Guess what? The price of Bitcoin has recovered each time. After the price of Bitcoin cratered in November 2021, for example, it quickly rebounded. In 2023, Bitcoin was up more than 150%, and in 2024, the price of Bitcoin is up 30%.

Ethereum

If Bitcoin is “digital gold,” then Ethereum is “digital silver.” Ethereum might not get as much attention as the world’s most popular cryptocurrency, but it is top-of-mind for many investors looking for safety in a volatile, uncertain crypto market.Collapse

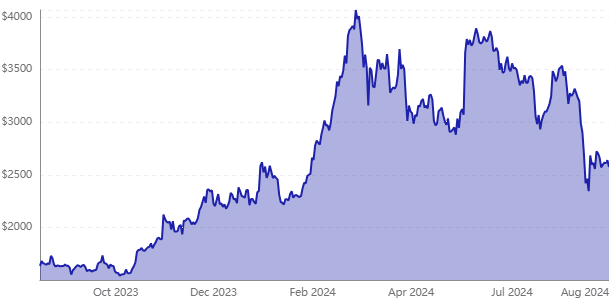

CRYPTO: ETH

One big reason for that has to do with Ethereum’s huge, sprawling blockchain ecosystem. This ecosystem gives Ethereum unparalleled diversification. For equity investors, it can be useful to think about Ethereum as a blockchain conglomerate that does a little bit of everything. That’s because Ethereum is a Layer 1 blockchain network that developers can build on top of in order to create new products and services. These can range from new crypto tokens to new decentralized finance (DeFi) exchanges.

Given how diversified these blockchain offerings are, and how big Ethereum’s worldwide developer network is, Ethereum can be a useful hedge against uncertainty in the crypto market. If one niche of the blockchain world is underperforming, there is likely another niche that is performing quite well. By way of comparison, a “metaverse coin” can disappear overnight if support for a particular trend or narrative evaporates.

It’s not just that Ethereum does a little bit of everything — it’s that it does everything extraordinarily well. There have been a handful of challengers that have attempted to displace Ethereum as the preeminent Layer 1 blockchain network, but none have succeeded. In DeFi, for example, Ethereum still commands a whopping 60% share of Total Value Locked (TVL), which is a key metric for measuring overall DeFi activity. For that type of market dominance, many investors are willing to pay a premium.

Buy and hold for the long haul

Together, Bitcoin and Ethereum now account for a whopping 70% of the total market cap of the crypto market. That figure could continue to grow, given that Bitcoin and Ethereum are still the only cryptocurrencies with their own spot ETFs. Bitcoin and Ethereum are now more accessible than ever for retail and institutional investors. As such, money should continue to flow into both, despite overall market conditions.

Over the long haul, I can’t think of two other cryptos that I’d rather hold in my portfolio. They are both proven winners, and both have solid long-term growth prospects. Yes, investing in crypto is risky, but Bitcoin and Ethereum have the historical track records to show that they can bounce back from adversity.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,072!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,733!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $371,318!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.